Form 2316

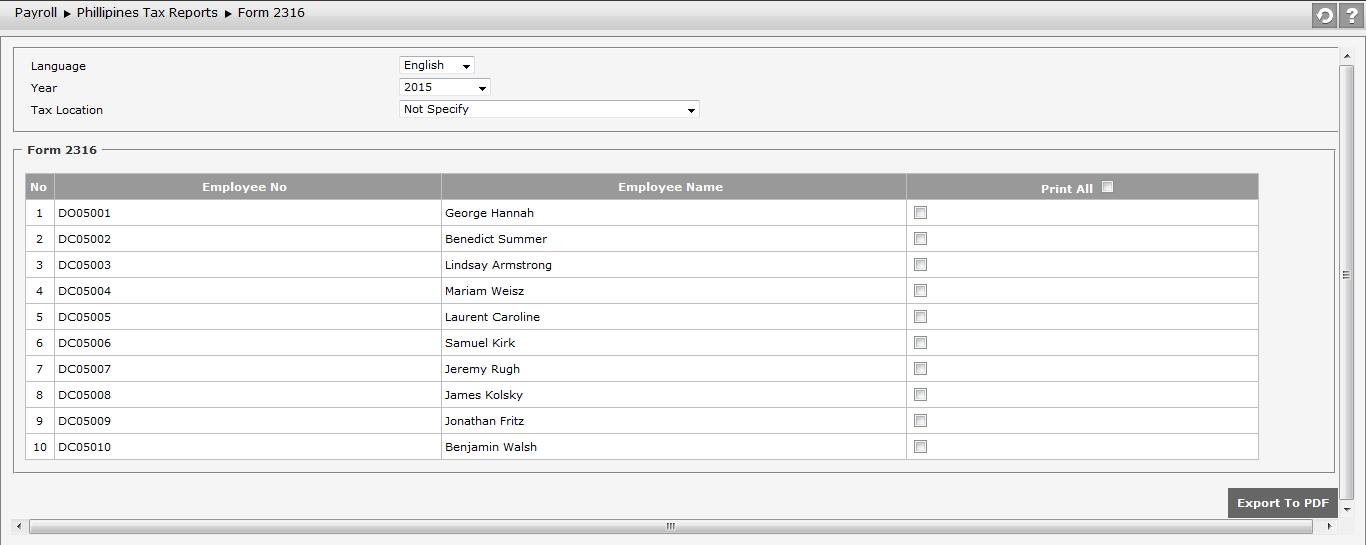

Form 2316 is used as an evidence that the tax has deducted the income. Form 2316 is also called as Certificate of Compensation Payment or Income Tax Withheld. This certificate must be generated every year by the employer for every employee whose income is deducted declaration final tax. The employer has to show the total of salary paid to the employee along with the tax deducted accordingly during the calendar year. To access this menu, go to Payroll > Philiphines Tax Report > Form 2316, then the following page will appear.

Follow these steps to prefie Form 2316:

- Language: Choose the language used in Form 2316, whether English or Philiphines.

- Year: Determine the year of which data will be displayed on Form 2316.

- Tax Location: Determine the tax location of which data will be displayed on Form 2316.

- Determine the employee whose tax data will be displayed on Form 2316. User may choose one or some certain employees by selecting the checkbox of each employee, or choose all employees by selecting Print All.

Once it's done, click ![]() to preview the Form 2316 in PDF format.

to preview the Form 2316 in PDF format.

Form 2316 consists of 5 parts, where each part has different information:

- Part I : Employee information

Part I shows the information of employee, which are:

- Tax Payer Identification Number: It is the tax ID number of employee.

- Employee Name: It is the name of employee, with the format of last name, first name and the middle name of employee.

- Registered Address: It is the current residential address of employee.

- Local Home Address: It is the address of employee based on employee's ID card.

- Foreign Address: It is the e-mail address of employee

- Date of birth: It is the birth date of employee, with the format of MM/DD/YYYY.

- Exemption Status: It is the exemption status of employee, whether single or married.

- Is the wife claiming the additional exemption for qualified dependent children: It is whether the employee's children are borne or not.

- Name of Qualified Dependent Children: Those are the names of employee's children who are the dependents.

- Date of Birth: Those are the birth dates of every employee's child who is a dependent.

- Statutory Minimum Wage rate per day: It is the average minimum wage per day.

- Statutory Minimum Wage rate per month: It is the average minimum wage per month.

- Part II : Employer Information (Present)

Part II shows the information of employee's current employer, which are:

- Tax Payer Identification Number: It is the tax ID number of employee's current employer.

- Employer Name: It is the name of employee's current employer.

- Registered Address: It is the address of employee's current employer.

- Zip Code: It is the zip code of employee's current employer address.

- Part III : Employer Information (Previous)

Part III shows information of employee's previous employer, which are:

- Tax Payer Identification Number: It is the tax ID number of employee's previous employer.

- Employer Name: It is the name of employee's previous employer.

- Registered Address: It is the address of employee's previous employer.

- Zip Code: It is the zip code of employee's previous employer address.

- Part IV-A : Summary

Part IV-A shows information of employee tax summary, which are:

- Gross Compensation Income from Present Employer: It is the summation total of Non-Taxable/Exempt Compensation Income Total and Taxable Compensation Income Total.

- Less Total Non-Taxable/ Profit Sharing Exempt: It is the total of non-taxable income.

- Taxable Compensation Income: It is the total of taxable income.

- Add Taxable Compensation Income from Previous Employer: It is the total of employee's income taxed from the previous employer.

- Gross Taxable Compensation Income: It is the summation total of Taxable Compensation Income and Add: Taxable Compensation Income from Previous Employer.

- Less Total Exemption: This value is based on the employee's exemption status. Both Single and Married have the same value which is 50000. This value of exemption status is set in Setting > Payroll Setting > Tax Parameter.

- Less: Premium Paid on Health and/or Hospital Insurance (If applicable): Currently it is zero.

- Less: Premium Paid on Health and/or Hospital Insurance (If applicable): Currently it is zero.

- Net Taxable Overtime Pay Compensation Income: It is the difference total of value.

- Tax Due

- Amount of Taxes Withheld Present Employer: It is the total of tax from the employee's current employer.

- Amount of Taxes Withheld Previous Employer: It is the total of tax from the employee's previous employer

- Total Amount of Taxes Withheld As adjusted: It is the summation total of Amount of Taxes Withheld Present Employer and Amount of Taxes Withheld Previous Employer.

- Part IV-B : Details of Compensation Income and Tax Withheld from Present Employer

Part IV-B shows the detailed information of income compensation and tax from employee's current employer. This part is divided into:

- A. NON-TAXABLE/EXEMPT COMPENSATION INCOME

- Basic Salary/Statutory Minimum Wage. Minimum Wage Earner (MWE)

- Holiday Pay (MWE)

- Overtime Pay (MWE)

- Night Shift Differential (MWE)

- Hazard Pay (MWE)

- 13th Month Pay and Other Benefit: The filled value depends on component value with the periodic class and exemption bonus. If the value of periodic component is higher than the value of exemption bonus, then the appeared value is the value of exemption bonus. If the value of periodic component is lower than the value of exemption status, then the appeared value is the value of periodic component.

- De Minimis Benefit

- SSS, GSIS, PHIC & Pag-ibig Contributions, & Union Dues (Employe share only) contains of the deduction total from employee's current employer as the employee's insurance guarantee

- Salaries & Other Form of Compensation

- Total Non Taxable/Exempt Compensation Income contains of the employee's non-taxable income total or the summation total of components in A.

- B. TAXABLE COMPENSATION INCOME REGULER

- Basic Salary

- Representation, Transportation, Cost of Living Allowance, Fixed Housing Allowance, Other Specify (Tax Reguler A dan Tax Reguler B) Supplementary, Commision, Profit Sharing, Fess Including Director’s Fees, Hazard Pay, Supplementary A dan Suplementary B contains of the component value set in Setting > Payroll Setting > 2316 Setting. The appeared component value is the value of component with allowance type.

- Total Taxable Compensation Income contains of taxable income total or summation total of components in B.